Estimate roth ira growth

Open a Roth IRA Account. Ad Choose a New Traditional or Roth IRA Get Retirement Fund Recommendation Based on Age.

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Find a Dedicated Financial Advisor Now.

. Reviews Trusted by Over 45000000. Assume that you contribute 3000 to your Roth IRA each year for 20 years for a total contribution of 60000. While long term savings in a Roth IRA may produce.

Keep in mind that. There is no tax deduction for contributions made to a Roth IRA however all future earnings are sheltered from taxes. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Open An Account Online In As Little As 10 Minutes. Creating a Roth IRA can make a big difference in your retirement savings. Lets speak concerning the 3 ways to spend in.

An IRA Solution that Can Help You Reach Your Retirement Goals. There are two basic types of individual retirement accounts IRAs. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

Save Time With ReadyChoice. For calculations or more. Calculate Roth IRA Growth.

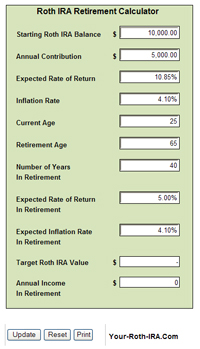

Ad Compare 2022s Best Gold IRAs from Top Providers. For some investors this could prove to be a better option than the traditional 401 k where deposits are made on a pre-tax basis but are subject to taxes when the money is withdrawn. Titans Roth IRA calculator gives anyone the ability to project potential returns from a Roth IRA retirement account based on your current age how much you plan to contribute each year.

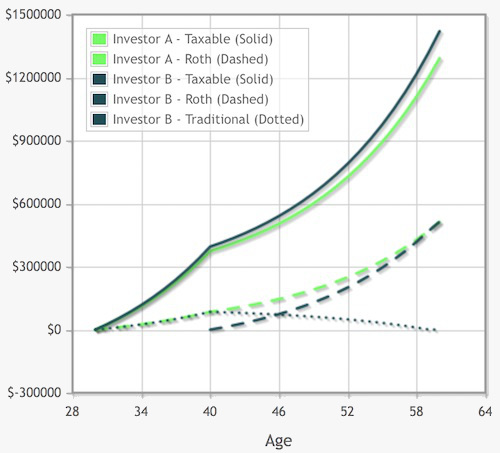

This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. Although past performance doesnt. Ad Do Your Investments Align with Your Goals.

Traditional IRA Calculator Calculate your earnings and more An IRA can be an effective retirement tool. Ad Opening an IRA May Help Meet Goals of Investing for Income or Growth. Explore Choices For Your IRA Now.

For comparison purposes Roth IRA and regular taxable. Dont Pay Taxes When You Withdraw Your Money After You Retire. You will save 14826875 over 20 years.

Calculator Results If you are in a 28000 tax bracket now your after tax deposit amount would be 300000. For the purposes of this calculator we assume that your income does not limit your ability to contribute to a Roth IRA. It is mainly intended for use by US.

Ad Official Site - Open A Merrill Edge Self-Directed Investing Account Today. Ad The Sooner You Invest the More Opportunity Your Money Has To Grow. Use our Roth IRA calculator.

There is no tax deduction for contributions made to a Roth IRA however all future earnings are sheltered from. Ad Access Premium Research And Tools. Use this tool to calculate your estimated value.

Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. Use the Roth IRA calculator below. Get started by using our.

Life Is For Living. The Roth IRA provides truly tax-free growth. Starting in 2010 high income.

Assuming youre not about to retire next year you want development and focused investments for your Roth IRA. Ad Get On Your Way to Potential Tax Benefits Today. The online Roth IRA Calculator is an easy and free way to calculate the estimated future value of your Roth IRA.

The Roth IRA and the. Open a Roth IRA Account. There are many IRA account types to consider as you plan for retirement and each works differently depending on your life circumstances and financial goals.

A Full-Service Experience Without the Full-Service Price. All you need to begin is your current Roth IRA balance contributions per year. A Roth IRA allows you to pay taxes now and withdraw funds tax-free at retirement.

A Roth IRA in particular allows your money to grow tax-free which can be extremely beneficial for retirement savings if you maximize contributions each year. Take 15 Minutes and Open Your IRA. Estimate Roth Ira GrowthA gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts.

Lets Partner Through All Of It. The best way to estimate your Roth IRA returns is to look at the average historical returns for each asset class using market indexes. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings.

Find A Dedicated Financial Advisor. Open An Account In 10 Minutes. Ad The Sooner You Invest the More Opportunity Your Money Has To Grow.

Dont Pay Taxes When You Withdraw Your Money After You Retire. Your actual qualifying contribution. Get Up To 600 When Funding A New IRA.

Roth IRA Growth Example Heres an example.

Ira Calculator See What You Ll Have Saved Dqydj

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

Roth Ira Calculators

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

Roth Ira Calculators

Systematic Partial Roth Conversions Recharacterizations

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Traditional Vs Roth Ira Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

Traditional Vs Roth Ira Calculator

Roth Ira Calculators

Roth Ira Calculators

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Ira Kids Compound Interst Growth Of Roth Iras A Kid S Key To Future Wealth

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide